Who are we?

Urbana is a Chilean real estate company in Latin America and it has provided for 23 years the highest standard of quality and services to our investors, clients and partners.

The portfolio of projects (in development, finished, acquired or managed by a third party) consists of 154 properties which include offices, residential and commercial centers. Currently, we are in charge of real estate assets of around 2.7 billions of dollars.

We have a team of experts (Property and Asset Management), which has a superior standard of operation and low cost in the market. We also have a pioneering range of real estate investment structure for clients and partners.

We have the expertise and the access to the institutional capital and we are therefore able to take charge of challenging investments, developments and projects of real state administration and we are therefore always looking toward the future.

History of Urbana

1996

Diego Durruty founded PIX Partners, a real state financial consultancy company that during its first seven years of its start-up, expanded to Argentina, Peru, Colombia, Venezuela and United States, it also has offices and franchises in Brazil and México.

Its quality of service has attracted important real state groups such as Prudential, Equity International and Kimco Realty, among others.

1997

Urbana handled the leasing of Shell Tower to Bellsouth and the sale of Shell Tower to Renta Ltda.

1998

Urbana took control of the portfolio administration of 19 buildings in La Parva.

2000

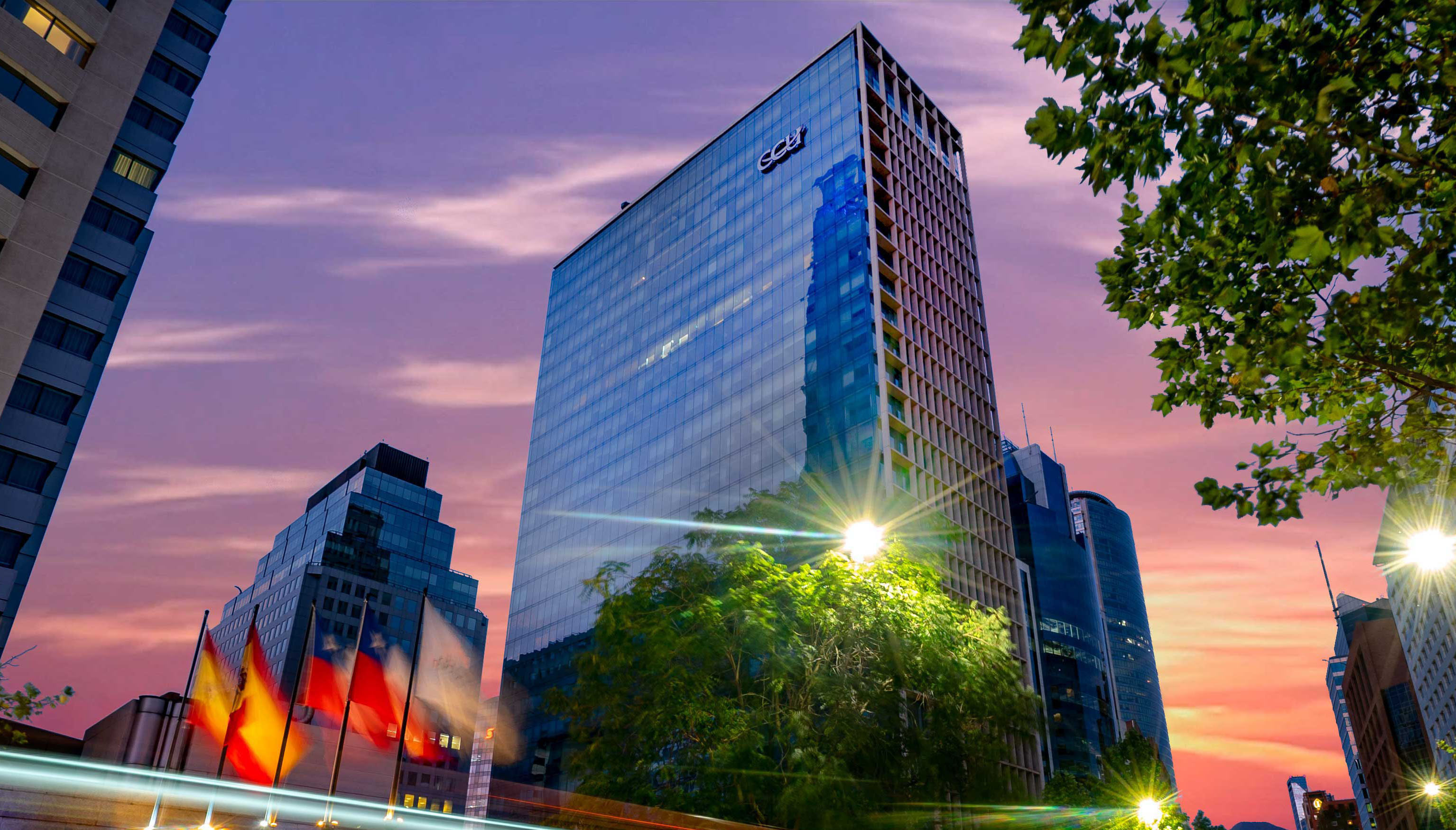

Management of pre-sales and a real estate development of CCU-Tower that was sold to Consorcio y Renta Ltda.

We ran our first International Architecture Contest which was won by +Arquitectos, Tuca Arquitectos, ADN Arquitectos, Flaño, Núñez.

2001

The french group, Auguste Thouard bought PixPartners Latinoamérica. It was the third French sales company of real estate services that had international recognition because it had great knowledge and experience in the real state area.

2003

Between 2003 and 2004, Urbana expanded by acquisitions, it bought 11 administration companies of buildings and communities reaching the administration of around 260 properties. Among the most important acquisitions Indoval, Administra, Flabbe, Realsa and ProAdmin stand out.

2005

Urbana Concierge was founded. This company provides and administers human resources for Offices-buildings, departments and commercial centers, having the highest standard of the industry.

2006

It managed the sales of 12.5% of Parque Arauco by Equity International.

2007

Urbana started the administration of strip centers. In 2009 Urbana Asset Management company that worked in the real estate assets administration (leasing) was founded.

Management of the buying of 50% Patio Centros Comerciales I and II by KimcoRealty.

2008

Management of the purchase of Power Center of D&S Viña Centro by Kimco Realty.

2009

PixPartners managed the buying of CCU Tower by Celfin.

2010

Se capta la Torre Alcántara de Celfin en administración de arriendos.

Se capta la Torre de Oficinas y Centro Comercial Isidora 3000 (W) en administración de arriendos.

Se capta la Torre SCL, propiedad de Prudential en administración de arriendos.

2011

The Torre Apoquindo, property of Celfin (leasing administration) was incorporated.

2012

Urbana Investment Management was born, focusing on projects management of public and private real estate investment.

2013

The general administration of Torre Isidora 3.000, Torre Territoria El Bosque, Torre Bersa Apoquindo and The Residential building Sara del Campo started.

2014

Urbana begin the general administration of Santa Rosa Building for “Prudential Real Estate”.

2015

Urbana begin with the administration of Parque San Luis and Sport Frances.

2018

Urbana acquires the Colegio Adventista’s land (9.000 sqm.) on Avenida Apoquindo with Luis Zegers in order to develop its first mixed-use project.

Mobil (Chile) and CallisonRTKL (US) won the international contest of Arquitecture (Urbana Center Apoquindo).

Mission and Principles

“We want to be the best investor and the best institutional developer and operator in Latin America”.

- The standard of Urbana represents the real estate benchmark in Latin America, regarding quality of service, integrity and value for clients and investor partners.

- All its products and services are of the highest quality and they meet their objectives.

- The collaborators and associates are the best example of its standards and are the most valuable assets of the company.

- Urbana is constantly working to be the leader within the industry regarding sustainability as well as the main real state company of the region.

Structure

Diego Durruty

Executive Vice President

Diego studied architecture at the Pontificia Universidad Católica de Chile and completed a Master’s in Management at the School of Civil Engineering at the same university. Diego has more than 25 years of real estate experience. He started in 1996 founding Pix Partners, a real estate financial consulting firm that expanded to 8 countries in America and Europe, and was sold in 2001 to the French group Auguste Thouard; currently being a subsidiary of Grupo Urbana, an integrated platform with multiple service and investment vehicles.

He also directs the Urbana Emprende program, to support entrepreneurs and through the Urbana Foundation, he collaborates with art with La Ermita and Mano Arriba social aid campaigns.

Andrés Durruty

Asset Management Manager

Andrés Durruty is a Commercial Engineer, MBA with 20 years of solid experience in the real estate industry. He has extensive knowledge in real estate administration and in the evaluation for the purchase of Office and Retail assets. He has vast experience in the complete management of Urbana companies, covering the areas of Finance and Administration.

He currently works as General Manager of Urbana Asset Management, dedicated to rent administration and real estate management.

Felipe Gilabert

Real Estate Committee

Felipe is a Civil Engineer from the Pontificia Universidad Católica de Chile. With one hundred thousand square meters built, Felipe has served as Commercial Manager in some of the most important real estate projects in the country, being a key player in the development of large-scale urban projects such as Nueva Las Condes.

Since 2000 Felipe has consolidated his position as Commercial Manager and Partner of Proyecta, a company that has developed emblematic projects such as the Monticello Casino, the Universidad de los Andes Clinic, the Nueva Santa María Tower, among many others.

Raúl Benavente

Real Estate Committee

Raúl is an Industrial Civil Engineer from the University of Chile. He is Chairman of the Board of Directors of the Center for Entrepreneurship and Innovation of the University of Santiago de Chile and a university professor.

With a broad career as a professional, Raúl is a Director of companies both in Chile and abroad. He has been an international consultant for governments, central banks and important organizations such as the UNDP – UN.

Rodrigo Durruty

Corporate General Manager

Rodrigo Durruty is an Industrial Civil Engineer with extensive experience in companies of various fields and as an independent businessman.

Rodrigo has served in senior positions and as a founder in companies such as Precisión Hispana, Distribuidora Montano and Austral Natura.

Today he is in charge of the Corporate Management of the Urbana Group companies. He leads the Property Management from where he supports the team of administrators in their operational tasks.

Main Clients

Prudential Real Estate Investors is the unit of the administration of real estate investment of Prudential Financial, Inc. The task of PREI’s is based on the execution of real estate strategies focusing in markets throughout the world which have a wide amount of institutional clients.

Since 1970 PREI has been investing in the real estate business for institutional investors having assets managed for USD $53.0 billion.

BTG Pactual Company (ex Celfín), is the biggest investment bank in Brazil. They, together, constitute the biggest investment bank in Latin America, taking in consideration its coverage and administered assets. They are recognized by its vision, creativity in its business and finance innovation around the world.

DWS is one of the largest European fund managers. DWS was founded in 1956 and is an integral part of the assets division of Deutsche Bank. DWS stands out for its performance, quality, innovation, and experience.

Being a branch of Banco de Chile, means security, solidity and support. This is the most prestigious private bank in Chile, having an impeccable trajectory. Banchile Inversiones has administered assets of people and companies for more than two decades, having as a main objective the achievement of the finance goals of its clients.

Equity International is a company of real estate institutional investment management that aims to help the rapid growth of world-class companies. This company does not only invest in capital but it uses its experience in operations and capacity in order to create value for a company. This company is recognized as one of the main international operators and investors. It was founded by Sam Zell in 1999.

It has a branch that works exclusively in real estate (Equity Residential) and another that works in offices (Equity Office), these being acquired several years ago by Blackstone group.

Kimco Realty is a real estate investment company. Which is the owner and operator of the majority of commercial centers in the United States. The company has held shares in New York since 1991, rating S&P 500 and having more than 50 years of experience.

BVK is the largest pension fund in Switzerland with more than 121.000 insured.

BVK has a large portfolio of direct and leased properties of around 5.000 apartments and 345.000 sqm of offices and commercial premises worldwide.